california renters credit turbotax

By Intuit 96Updated July 12 2022. The 2019 earnings limits are 42932 single and 85864 married.

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes

A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4.

. I am a college student filing. The credit will offset the taxes paid to the other state so you are not paying taxes twice. 43533 or less if your filing status is single or marriedregistered.

For example if you live in California you may qualify for a renters credit if you pay rent for your housing your income is below a certain amount and you meet other state. Check the box Qualified renter. Single filers who fall under the.

Entering a repayment of First-Time Homebuyer Credit on Form 5405. Lacerte will determine the amount of credit. You paid rent in California for at least 12 the year The property was not tax exempt Your California income was.

Entering Form 8846 credit information makes the balance sheet out. To claim the CA renters credit Go to Screen 53 Other Credits and select California Other Credits. A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4.

You may claim this credit if you had income that was taxed by California and another state. Renters in California may qualify for up to 120 in tax credits. Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked.

Turbotax Owner S Acquisition Of Credit Karma Could Spark Antitrust Concerns Bloomberg

Intuit Will Pay Millions To Customers Tricked Into Paying For Turbotax Propublica

California Earned Income Tax Credit And Young Child Tax Credit Ftb Ca Gov

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Intuit Will Pay Millions To Customers Tricked Into Paying For Turbotax Propublica

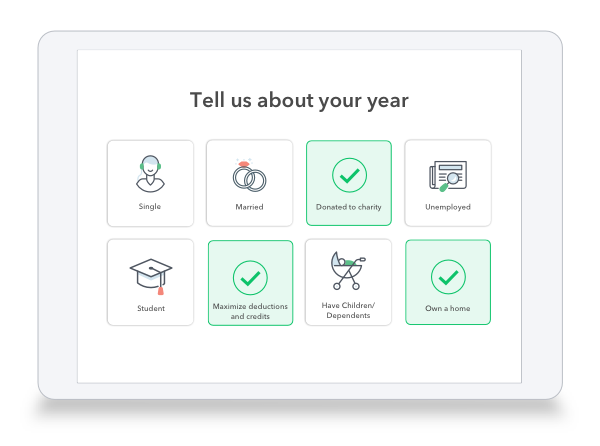

Turbotax Deluxe Online 2021 2022 Maximize Tax Deductions And Tax Credits

Intuit Responds To Complaint From U S Federal Trade Commission Business Wire

5 Ways California Tax Filers Leave Money On The Table Kpcc Npr News For Southern California 89 3 Fm

Can Housemates Claim The Nonrefundable Renter S Credit When I M The One Who Pays The Rent To The Landlord California R Tax

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Credit Karma To Offer Tax Filing Through Turbotax Forbes Advisor

Turbotax Refund Advance Loan Review Credit Karma

Video How To Amend Taxes That Are Already Filed Turbotax Tax Tips Videos

Taxact Vs Turbotax 2022 Nerdwallet

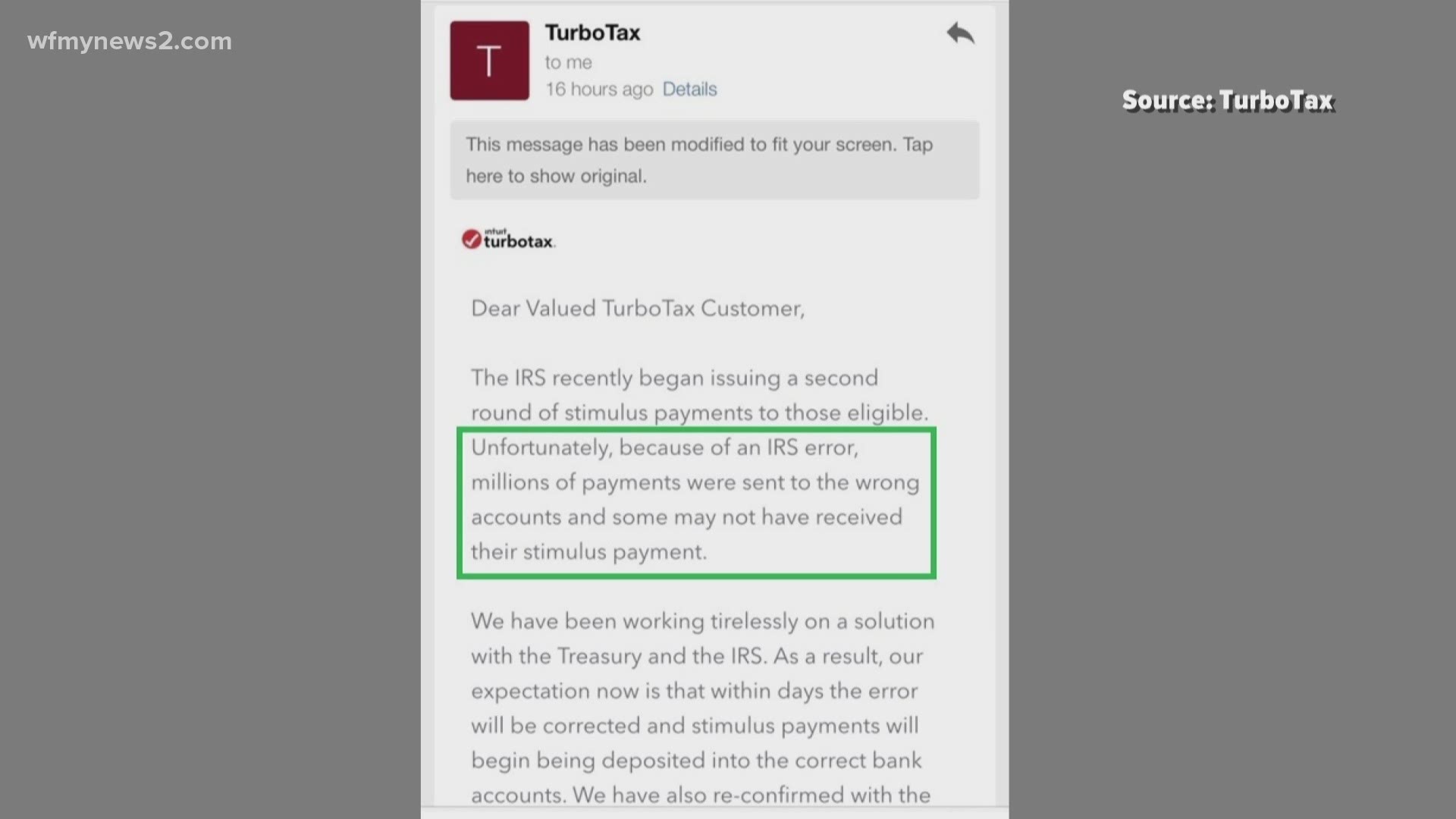

Turbo Tax And H R Block Customer Waiting On Stimulus Payment Wfmynews2 Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

I M Renting A Apartment It Didnt Ask Me Any Of That Do I Go Somewhere Else On Here To Claim That

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com